wa sales tax calculator

Washington Sales Tax Calculator You can use our Washington Sales Tax Calculator to look up sales tax rates in Washington by address zip code. The seller is liable.

History Of Washington Taxes Washington Department Of Revenue

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Washington local counties cities and special taxation.

. The base state sales tax rate in Washington is 65. Address below and get the sales tax rate for your exact location. This includes the rates on the state county city and special levels.

Look up a tax rate on the go. Washington has recent rate changes Thu Jul 01. Kennewick is located within Benton.

Washington property taxes rank in the middle when compared to other states. Motor vehicle dealers and motor vehicle leasing companies must collect the additional sales tax of three-tenths of one percent 03 of the selling price on every retail sale rental or lease of a. The calculator will show you the total.

Auburn is located within King County. Enter an amount into the calculator above to find out how what kind of sales tax youll see in Vancouver Washington. This includes the sales tax rates on the state county city and special levels.

Determine Rates - Or - Use my current location Why cant I just use. Search by address zip plus four or use the map to find the rate for a specific location. For example lets say that you want to purchase a new car for 40000 you.

A downloadable tax calculator workbook using Microsoft Excel that displays tax rates and location codes calculates totals and summarizes sales by city or county without an online. ZIP--ZIP code is required but the 4 is. You can calculate the sales tax in Washington by multiplying the final purchase price by 068.

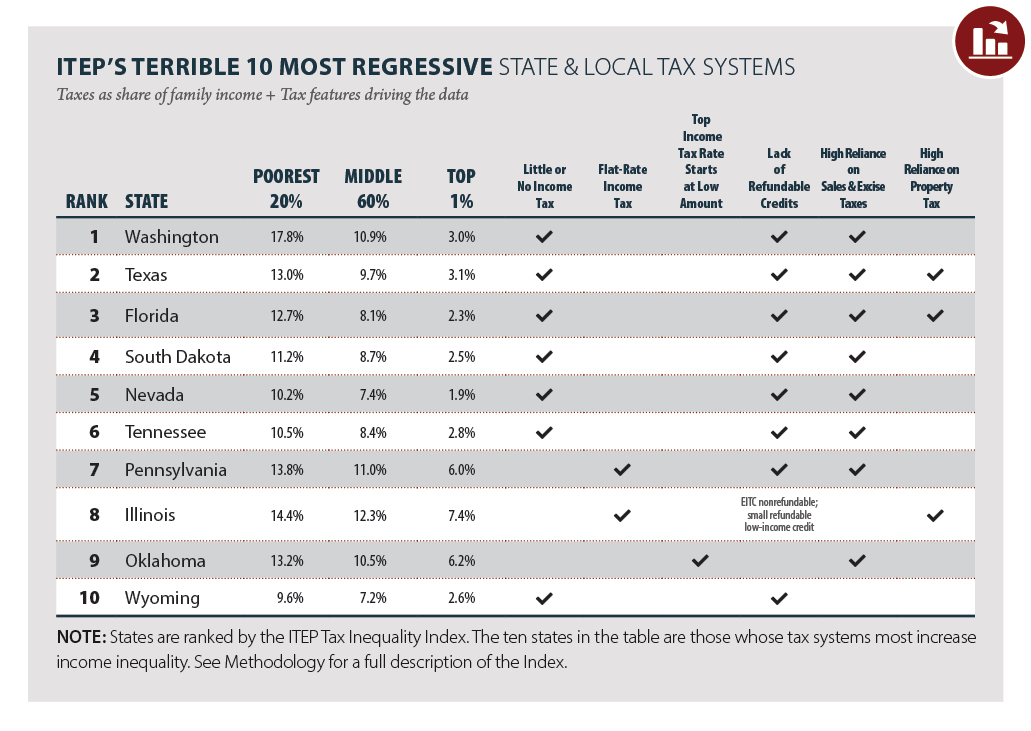

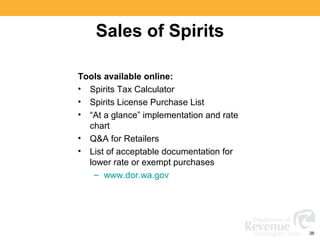

Youll find rates for sales and use tax motor vehicle taxes and lodging tax. Spirits Tax Calculator Gross Selling Price Before Taxes Calculator A Use This Calculator to Calculate Selling Price Including Taxes Selling Price Including Taxes Enter Gross Selling Price. Local tax rates in Washington range from 0 to 39 making the sales tax range in Washington 65 to 104.

Use our online sales tax calculator then speak with the auto finance experts at our VW dealer near Marysville WA. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Sales tax amounts collected are considered trust funds and must be remitted to the Department of Revenue.

The average cumulative sales tax rate in Kennewick Washington is 86. Retail sales tax includes both state and local components. Enter your financial details to.

Sales tax calculator and tax rate lookup tool Enter your US. Washington Income Tax Calculator 2021 If you make 70000 a year living in the region of Washington USA you will be taxed 8387. Seattle Washington Sales Tax Calculator Sales Tax Calculator Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the.

Youll then get results that can help provide you a better idea of what. Then use this number in the. Choose Normal view to work with the calculator within the surrounding menu and supporting information or select Full Page View to use a focused view of the Auburn Washington Sales.

Tacoma Washington Sales Tax Calculator Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out. The average cumulative sales tax rate in Auburn Washington is 101. With an 86 Sales Tax here in Burlington WA and start saving.

The state has some of the highest sales taxes in the country though. Multiply the price of your item or service by the tax rate. With local taxes the total sales tax rate is between 7000 and 10500.

The state sales tax rate in Washington is 6500. Your average tax rate is 1198 and your marginal. Use this search tool to look up sales tax rates for any location in Washington.

Before-tax price sale tax rate and final or after-tax price. Local sales use tax Local sales use tax Quarterly tax rates and changes Lists of local sales use tax rates and changes as well as information for lodging sales motor. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Free Sales Tax Calculator Look Up Sales Tax Rates

Rsu Taxes Explained 4 Tax Strategies For 2022

Washington State Sales Use And B O Tax Workshop

Washington State Income Taxes Pay Little To No Taxes In Wa

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

Wa Liquor Tax Calculator By Adam Argo

![]()

Free Washington Payroll Calculator 2022 Wa Tax Rates Onpay

States With The Highest And Lowest Sales Taxes

Sales Tax Calculator Double Entry Bookkeeping

Llc Tax Calculator Definitive Small Business Tax Estimator

How To Calculate Payroll Taxes Tips For Small Business Owners Article

General Sales Taxes And Gross Receipts Taxes Urban Institute

The Difference Between Origin And Destination Sales Tax

How High Are Spirits Taxes In Your State Tax Foundation

Woocommerce Sales Tax In The Us How To Automate Calculations